2018-03-01

IFI and dismemberment of ownership

From ISF to IFI: some changes for bare owners and usufructuaries

The legislator now distinguishes usufruct on a legal basis and usufruct on a conventional basis.

Until the reform came into force for the year 2018, the usufructuary declared his real estate assets and paid the ISF as if he were the sole owner.

These changes must now be taken into account to determine whether its net property wealth reaches the tax threshold of the IFI of € 1.3 million.

When the constitution of the usufruct results from an agreement, a gift or a will, and not from the will of the legislator, the imposition is entirely on the usufructuary.

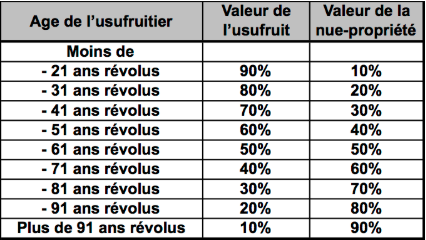

On the contrary, when the dismemberment results from the application of the law (legal usufruct of the surviving spouse), the tax is distributed between the usufructuary and the bare owner in proportion to the respective value of usufruct and nakedness. -property, defined by law according to the age of the usufructuary.

The impact is to be watched as it can be important for the bare owners.

.jpg)

.jpg)