2019-12-20

Christmas market point 2019

The Basque Coast, still popular with investors!

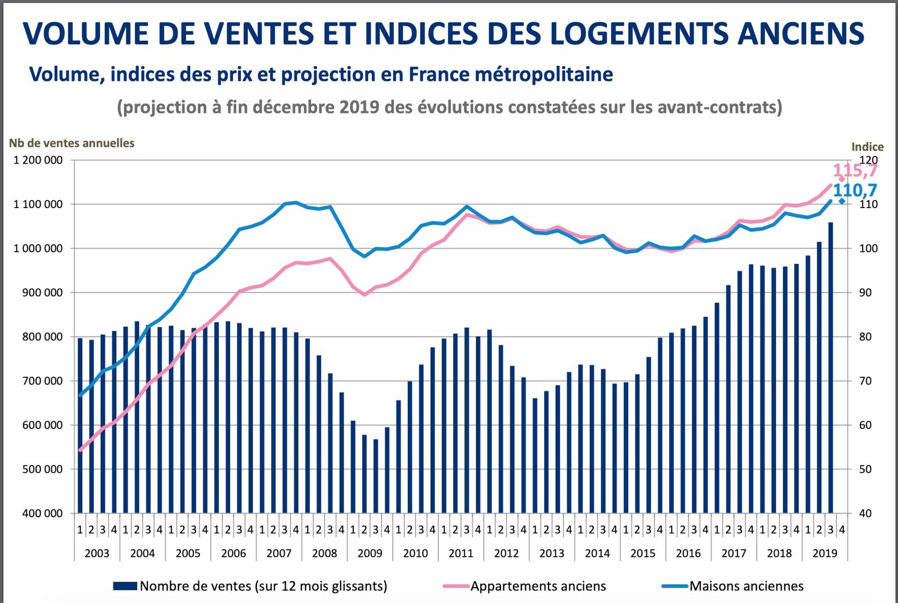

If real estate on the Basque Coast is beating records after records, it is above all a phenomenon that is observed at the national level: France is experiencing an exceptional craze for real estate, because after having remained around 800,000 annual transactions for more than 15 years, the number of real estate sales has skyrocketed since 2016. In 2018, the number of transactions had approached the million mark, but this year 2019 should set a new record with nearly 1,020,000 real estate transactions .

The Parisian market sets the tone with constantly rising prices, which have on average quadrupled (+ 300%) since 1998. If this price increase has not been passed on everywhere in France in the same proportion, we can observe that prices on the Basque Coast have appreciated over the same period by around 200%.

Thanks to our 3 offices, in Biarritz, Saint-Jean-de-Luz and Hossegor, and the fifteen consultants who work there, we have a fine knowledge of the market, which allows us to also observe a "scissors" effect with a strong demand in the face of reduced supply. This applies as much to the main residence as to the second home, and whatever the market segment. This asymmetry between buyers as numerous as they are motivated, and relatively stable sellers, allows the latter to be more firm on their conditions: estimates revised upwards, deadlines that suit them, and discreet work in "off market", to certain goods whose qualities allow working on file. 3 of our best sales this year came about in this way.

On our core business, prestige real estate, a real domino effect is fueling dynamism and rising prices. Indeed, the Parisian market, (which represents the largest number of buyers of second homes on the Basque coast), makes it possible to reinvest "Parisian capital gains" in Basque real estate projects.

This makes our region ever more dynamic (+ 9% of transactions in 2019 vs 2018) and the average prices constantly increasing: by 3.4% over 12 months, and 6.9% over 2 years for the Pyrénées Atlantique.

The coastal market is doing even better, far from "reasonable" averages, with average prices increasing in Biarritz by around 19% in 2 years!

Fortunately, the organization of the G7 does not seem to have had any impact, neither positive nor negative: neither the pace of sales nor the price level has been revised downwards.

How to explain such enthusiasm? In addition to the domino effect pulled by Paris, we can obviously evoke ever lower interest rates (less than 1%, even over 20 years), and the level of world stock markets which reached records, in particular for the Dow Jones ( absolute record tied this week), and for the CAC40 (highest since 2007). This confidence in the financial markets echoes the real estate market.

To make a connection with current events, we can also think that the uncertainty about the future of the retirement system is prompting more and more French people to invest in stone for a rental yield. Even if the return remains modest, it is real, not to mention a possible latent capital gain.

The attractiveness of our region is always explained by the quality of life that we find there with a feeling of security and knowing (well) how to live.

Faced with this enthusiasm observed in every segment of the real estate market, the town halls are trying to provide certain "solutions":

At the regulatory level:

Some cities, such as Biarritz, are increasingly controlling the craze for LMP / LMNP status, limiting rental to one single property per owner (i.e. 2 per couple, and per municipality ... excluding SCI), which makes the rule not very restrictive in reality. While the reform of the housing tax will exempt 80% of French people in primary residence, the housing surcharge is hardly prohibitive and remains a political signal.

In terms of town planning:

The densification of housing in all the municipalities close to the coast is starting to pose problems of access to the coast; cities are setting up more conservative town planning rules (PLU and zoning) ... this reinforces the attractiveness of properties with a location offering a way of life on foot. Paradoxically, the attractiveness of internal municipalities is torn between a general rise in prices (driven by the coast), and the problem of ever more intense traffic, without adequate road infrastructure.

Tools allowing everyone to know the price of transactions over the past 6 years are cleaning up the market to allow sellers, as well as buyers, to stay connected to reality, without amplifying an already significant price increase. By knowing the state of supply and demand, we try to realistic value of goods while putting them in perspective of current demand

Our knowledge of the market allows us to better interpret this rich mine of information, and to make the figures speak for themselves completely obscure for the uninitiated. This allows us to provide the most objective advice possible to our customers who may be confused by all this raw data without relief.

The outlook for the coming year is auspicious, with an accommodating monetary policy, Sino-US trade relations moving towards appeasement, and finally an exit of the United Kingdom from the European Union, putting an end to 3.5 years of negotiations with uncertain consequences.

Social demands in France and the lack of impact (no violence / ransacked shops / public transport strike) on the Basque country also accentuate the attractiveness of our region, which can be considered privileged.

The teams from Biarritz, Saint-Jean-de-Luz and Hossegor join me in wishing you an excellent Christmas and New Year's Eve.

Philippe Thomine-Desmazures

Sources: Capital / Chambre des notaires / Meilleurs agents / Les échos

.jpg)

.jpg)

.jpg)