Real estate market

2025-10-10

Autumn 2025 Basque Coast Real Estate Market Update

Supply-side or Demand-side Policy?

After a clear rebound in property transactions over the past twelve months, following the sharp slowdown observed both nationally and locally, we aim to gain a deeper understanding of the underlying factors in order to better grasp the reality of this highly specific real estate market in which we operate.

Each month, we closely monitor several key indicators:

- the evolution of supply

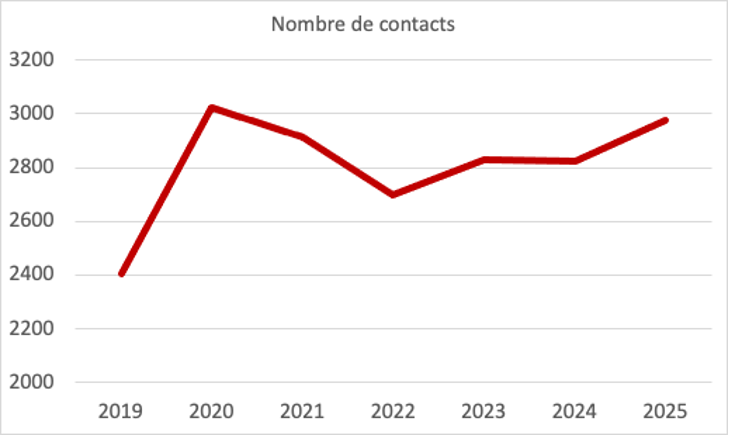

- the evolution of demand

- the evolution of prices (which theoretically result from the first two indicators)

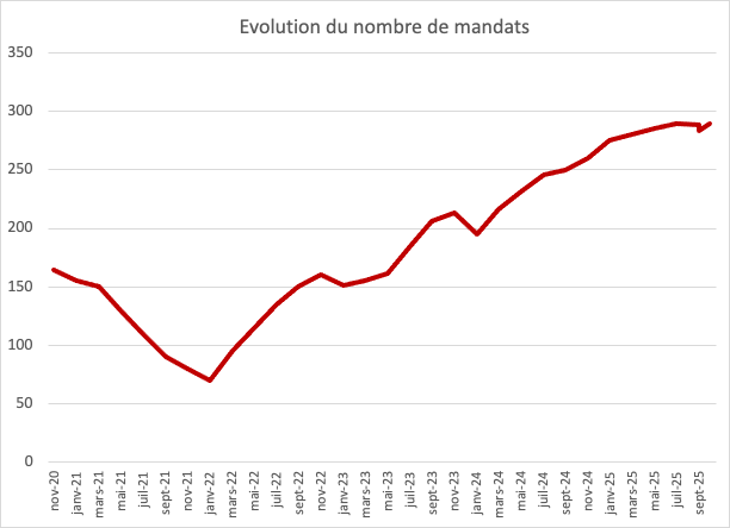

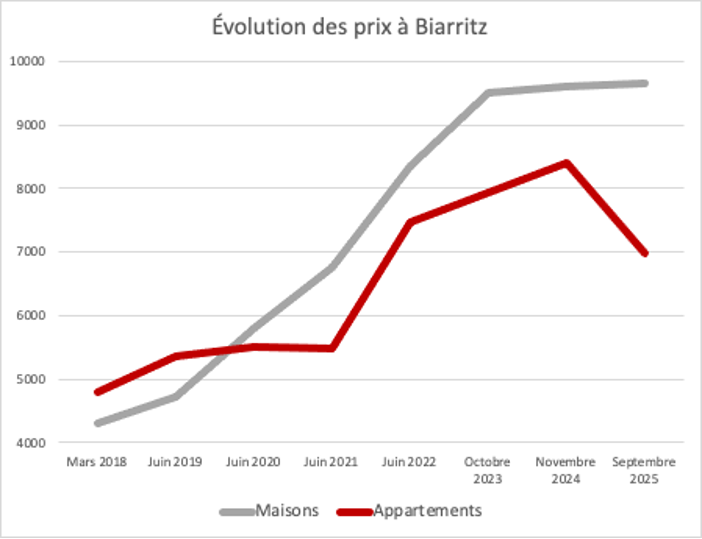

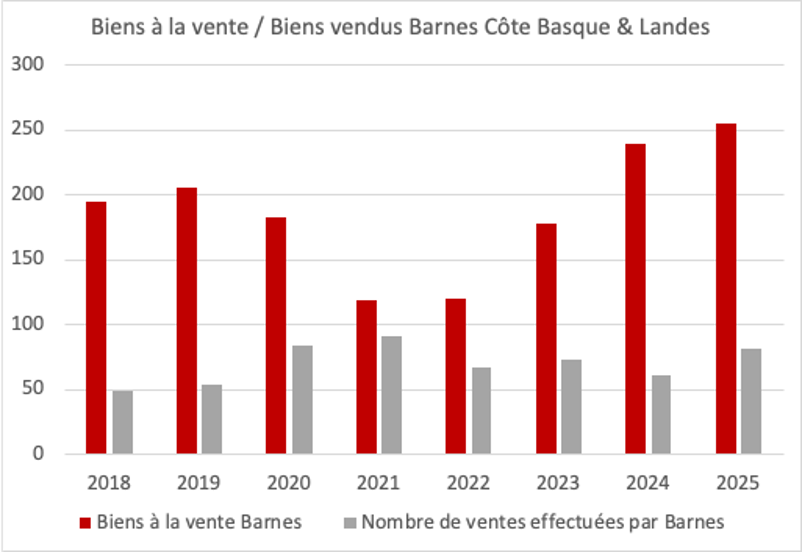

The market recovery observed since spring 2024, with a brief pause following the dissolution of the National Assembly, and confirmed since autumn 2024, has proven remarkably resilient despite political and economic turbulence, echoing trends seen in the financial markets. As we have noted for over two years, and following broad-based inflation including real estate, we have witnessed a sharp increase in the number of mandates. Despite a certain price inertia between late 2022 and late 2023, we are now seeing a genuine price correction, particularly across the apartment segment.

Although around 70% of our buyers do not require financing, the steady decline in mortgage rates, continuously falling since December 2023 to around 2.9% over 15 years, and the easing of lending conditions have restored overall momentum to the property market.

Recent regulations on the control of short-term rentals, now restricted to primary homeowners, and the implementation of rent controls are having a dual impact on both supply and demand. With rental activity becoming less feasible and financially attractive, selling or acquiring property has emerged as the most rational option, provided that prices are properly adjusted.

This renewed momentum, initiated roughly 18 months ago, is therefore based on both a strong and sustained level of supply and a demand that is regaining vitality. Nevertheless, it is worth noting that the greater market fluidity driving this recovery has not yet led to price stabilization: apartment prices, in particular, continue to experience a modest correction necessary to restore balance. With fewer but financially qualified buyers, sellers are showing increased willingness to negotiate in order to reach an agreement. Yet, while the market is becoming more dynamic again, the equilibrium remains fragile. The economic climate, political uncertainties, and ongoing geopolitical tensions continue to pose potential risks, making this recovery somewhat precarious.

We are familiar with the government’s long-standing supply-driven economic strategy and its mixed results across various sectors. When applied to the prime real estate market along the Basque Coast, however, the outcomes appear far more positive: buyers now benefit from greater choice, with a steady rise in mandates over the past three years, while price adjustments have made new property projects more attainable for financially capable clients. That said, the premium, luxury and ultra-luxury segments in which we specialize could still face further headwinds if fiscal policy becomes less favorable, with measures such as the Zucman tax or potential reinstatement of the ISF, CEHR and CDHR, potentially dampening demand.

The Basque real estate market, and even more so its high-end segment, continues to demonstrate remarkable resilience. But can this strength endure indefinitely?

Philippe Thomine-Desmazures

Associate Director

%20(1).jpg)

.jpg)

%20(1).jpg)